Last week I wrote about strategy and how you can formulate one to help manage your business growth. This week, I’m covering the growth stages for small and medium sized businesses and the optimum strategies for each stage. I’ve been talking about this concept of the common challenges and similar characteristics in distinct growth stages for years now, so I thought I’d better publish something on it. The idea of ‘benchmarking’ always struck me as overly simplistic, given that markets are always made up of businesses of different shapes and sizes. I think we can do better.

I’ve been helping business owners with their frustrations about growth and worries about selling their businesses, for over seventeen years now. What I’ve discovered from the experience and accumulated data, is that while there are clearly growth stages, not every business goes through all of them. It’s also possible to have a happy life and realise your ambition, without going through every stage. Indeed the last two stages break many that attempt them.

You could think of the growth stages as a range of mountains and me as your sherpa. In this blog, were going to climb the range. Before we set off, a couple of clarification points.

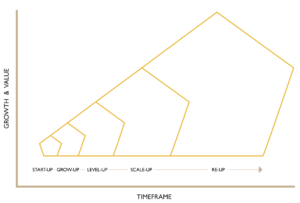

- There are five stages, made up of characteristics, like a personality. Think shape, and size.

- A different approach to management and growth is required for each stage. There’s also an optimum strategy to get you through each stage and they’re covered below.

- These stages relate to small and medium sized businesses.

- I’ve not found any particular type of business where these stages don’t apply.

- A funded ‘start-up’ may move through the same stages, but in a much shorter timeline.

- The ‘lifestyle’ vs ‘enterprise’ distinction (read more here) is a simplification, but it is part of the growth stages.

- You can exit your business and capture value, in four out of the five stages.

- In general, a business becomes less fragile as it moves through each stage and this increased strength has a positive impact on funding, recruiting, performance, business value and indeed the odds of moving to the next stage, should that be desirable.

- Understanding the firm’s current and next growth stage is fundamental to creating a plan that helps leverage resources while managing risk. A map if you will.

- Attempts to skip growth stages often leads to failure.

Each side of the pentagon shape in the graphic represents the five key aspects of a business. Namely Leadership, Marketing, Team, Operations and Finance. We score these areas against model characteristics for each aspect of the business, at each growth stage. The result is often an asymmetrical shape. A business with a symmetrical shape, is optimised for the growth stage it’s in. Performance improvement follows optimisation. Symmetry in business, as in many aspects of life, represents balanced proportions and harmony. Do what’s necessary to make your pentagon symmetrical and you increase the probability of optimising your performance and value.

Start-up

Right, let’s have a go at the first mountain in the range. It’s a nasty one as it’s your first. You don’t know what you don’t know. But for whatever reason, you’ve decided it’s going to happen so you just take the first step on your journey to viability and the summit. As we start walking, let’s talk about product-market fit. You’re trying to create a viable business so all you should care about is finding people with a problem that either you or your product can fix. Find enough people with the same problem, make enough money fixing it and we’re at the summit. Sounds simple but it’s anything but. For a start you’ve probably not done this before, so you’ll find yourself doing a lot of tasks for the first time. As the owner, you need flexibility, grit, and determination. Not to mention creativity.

Your business will need a few tools to help with product-market fit including ‘minimum viable product’, ‘minimum viable audience’, and the ‘scientific method’. The first should be obvious. Avoid spending significant resources on a proposition that is untested. Get to the minimum viable product as frugally as you can. At the same time, you need the smallest viable market to work with. Many entrepreneurs focus on solving a problem they themselves have. This is sensible, as you can then sell the solution to people like you. As Kevin Kelly famously wrote in his timeless essay (read it here), you only need a thousand true fans to create a successful commercial endeavour. And finally, the scientific method, which is at the heart of every good strategy. Create a hypothesis, identify the leaps of faith, set out success criteria and away you go. Think of each client as a controlled test. Monitor and adapt as you go.

The summit of Start-up Mountain (your strategic goal) is viability. Experiment your way to product-market fit with your minimum viable product, don’t run out of cash, and all things being equal, you should have a viable business. If you can visualise a complete year in business and you have the clients and cashflow to support it, you’ve climbed the first mountain. Peak one done. Could take a few weeks or a few months, it’s often a year.

Grow-up

Okay so now you’re a mountain climber. You might like to take it easy as you descend the first peak and prepare for the next one in the range. Take care though, more accidents occur on the decent than the ascent. You’ll have to stay focussed. This is where Grow-up Mountain starts and it’s a horrible peak to climb. The route is often obscured and the weather can be unpredictable. The peak of this summit is capability.

The main challenge is that you’re going to need to build a team and reach a point where that team is capable. By ‘build’, I mean hire, wire and inspire. Hopefully not fire, but let’s be realistic, that’s probably going to happen too. And you must do all this while keeping existing clients happy and taking on new ones. The reason is simple; you want to maximise your potential, so you surround yourself with people who can do the things you can’t, don’t want to or shouldn’t be doing. The thinking is that this small team will improve top line revenue and the bottom line will incrementally improve too. You need to be confident and your management approach should be directional. Inexperienced individuals and young teams need this.

You may already have a few people in a small team, but you now need to build this out to a full compliment. That means creating all the systems and processes to support the team, so they can support your clients. Focussing on the ‘client experience’ helps here. Identify the various activities that make up your proposition and critically, the value delivered to both the client and the firm as you move through the proposition. You should also highlight tangible deliverables, processes and gaps that need filling.

You can map out your entire timeline from first contact with a prospect, right through the core proposition delivery and on into the ongoing service. You can then develop standard operating procedures for consistent delivery. Work on this with the entire team and they will gain invaluable insight into what you do for clients and how it helps them. You’ll also find out where the gaps in the teams’ capabilities are. The project plans and personal development plans that flow from this work, are likely to be rudimentary at this stage, which is fine. Just make sure there is something documented and that the appropriate incentives are in place to increase the probability of success.

The grow-up summit is capability. When everyone in your team is capable in their defined role and the team generates more than it costs, you’re there. If you had to sink capital into your business when you started it, you should breakeven in this stage. You could technically sell a business like this but don’t expect a premium. There won’t be that much excess profit after you’re paid and a buyer will typically only have enough confidence in your future cashflows, to pay you about four times that net profit figure.

You will work harder in the Grow-up stage than you ever thought possible. This will have a knock-on effect, so relationships outside of work will become strained, your health may suffer and so will your bank balance. This last one is particularly hard to take. There’s a horrible period where you’ve loaded up on costs, and no one seems to know what they’re doing. Patience and ego management are essential personal skills to develop while in this stage. Just take deep breaths and keep checking the map.

Level-up

As you submit the Grow-up peak you can see Scale-up Mountain rising majestically in front of you. Whether you’re frightened or excited, you shouldn’t remain at the summit of Grow-up. It’s frustrating and potentially dangerous to stay here. What you don’t know is that you can’t get to Scale-up Mountain from Grow-up Mountain. You need to move laterally and when you do, you’ll see another mountain in the range that connects Grow-up with Scale-up. This is Level-up Mountain and it has a unique challenge in store for you.

It’s a long climb and progress can be slow. As you climb, you will see alternative routes that appear to lead directly to Scale-up Mountain. Problem is, none are viable and many are dangerous. You might be tempted to try a short-cut but when you reach a crevasse, you’ll need to retrace your steps to get back on the right path. The summit of Level-up (your goal) is consistency, and the route up is not obvious. You need to be humble and your management approach should focus on delegation.

By now you probably have one or more fee earners working in the firm. They might be pure sales or sales and technical delivery. You have a proposition and processes to increase your support teams’ efficiency. There’s some technology being used to drive the processes and tools to help manage risk. You might have a dedicated manager on the team and if you don’t, you’re planning to hire one soon, right? Financial performance is generally pretty good and the business supports your improving lifestyle. This all sounds okay. Why not just stay doing this, or go for scale? Well, just imagine you took a month off. Would the business function as well as when you’re there? I doubt it. What if one of your support team was off for a month? Make an impact? In fact, you have little pockets of risk right across your business. Single points of failure that aren’t always obvious, but they’re there, hampering performance and holding down business value. Up to now, you’ve been building your business around you, but now it’s time to change that.

The central strategy for the Level-up stage is something we call ‘goodwill transfer’. Goodwill is the value a business derives from its brand, client base, reputation, and intellectual property. It’s an important element of most business valuations, as it reflects what the business creates with the assets it owns. Goodwill is intangible. In a small business it often resides with individuals and that’s a problem, as they can be removed. In corporate finance parlance, we refer to this kind of business as a ‘ball of chalk’. It looks real but one puff and it’s gone.

You need to make the intangible, tangible. Personal relationships and team culture need to be transferred into a brand. Client empathy, solutions and technical knowledge must come together to form a rock-solid client proposition and a library of intellectual property and tools, that everyone uses the same way. Good behaviours must become standard operating procedures and roles should be defined and compensation aligned. Strategic planning is essential here as there’s a lot going on. Cascading the firm’s goals throughout the business and assigning accountability for delivery is essential (read more about that here). It should go without saying, but all client relationships should be owned by the business and not individuals.

Working on marketing is a great way to tackle all this. Thinking about who you serve, why and how, allows you to both zoom out and back in to specific areas of detail. There’s a strong incentive for fee earners to engage in this project, as they want more clients. The support team will also contribute as they can often see benefits accruing to them in the form of clarity on proposition and the ability to nail down standard procedures as a result. Both make it easier for them to excel in their roles.

You’ll know you’ve reached the summit of Level-up Mountain, when your business performs consistently, without relying on any one individual. That performance should include organic growth and importantly, you will know what drives it. The experience is more endurance than excitement. Once here, you can stay on this summit long term. It’s safe and you don’t have to keep climbing. Bank the profits and sell the business when you’re ready. It’s a solid, predictable, growing business, so you shouldn’t struggle to find a buyer willing to pay you six to eight times profit for it. If, however, your ambition extends beyond being comfortable, something truly life-changing awaits.

Scale-up

So here we are, finally. About to climb Scale-up Mountain. Looking back, you can now see why the route you took is pretty much the only viable one. What lies ahead is the most demanding of all the climbs. It’s also the most exciting and dangerous. We’re going to climb into the ‘death zone’ on this climb (above eight thousand meters the pressure of oxygen is insufficient to sustain human life), so it’s just as well we have the experience of the other climbs to help prepare. The summit of Scale-up (your goal) is momentum. You will need to move from direct management to leadership and focus on communication and coordination.

First let’s define scale as it’s frequently misrepresented. To scale a business is to increase revenue faster than costs, so that profit grows exponentially. Typically this means lowering the cost of production. This is important to keep in mind. Tech businesses scale better than service ones, but it’s possible to scale both. In this stage you’re committing to growth and that means investing. And when you’re investing, you’re expecting a return, so planning, costing and identifying projects that create the highest return is important.

While were on the subject of money, this is the stage when you need to get serious about the numbers. You must understand the capital structure (who owns the business and how it’s funded), your working capital (the effect of expansion or contraction on cashflow) and liquidity (how much of your cashflow is ‘free’ at any given time). As the leader, you should have a strong grasp of these subjects, so you can have sensible conversations with your management team and make good decisions.

About that management team. By now, you’ve exceeded your own span of control. You cannot directly control a firm of this size, so you must get the right managers in place, work with them to formulate a strategy and delegate responsibility for implementation. Codifying decision rights is essential at this point. As the leader, you will struggle to stay on the tools. If you want to scale, you need to be in a dedicated management role, as do your other managers.

Our strategy is focussed on two main areas; technology and people and how we generate leverage from the combination. On the tech side, you’ve already started building digital assets (intellectual property) and you’re going to want to extend this to a platform of educational content and tools for prospects and clients alike. Ideally, the final shape of this platform, will be a hybrid version of your proposition. Users can navigate your proposition online, supported by video how-to’s, tools and templates. Their progress can be checked and supported by humans (your team) and they’ll pay a subscription for access, with fixed or success fees for project work.

All this platform activity generates data and you want to harvest it, so you can provide a first-class proposition, while gaining valuable insights and improving efficiency all at the same time. This means taking an ERP approach (enterprise resource planning). The result will be a single point of data entry and a system that allows that data to flow safely to any device while the proposition is delivered. You can build this using a combination of retail software or in house in stages. The latter is costly but it should add to the value of the firm, so it’s not just operational cost.

And what about people. Well, humans don’t scale all that well, but we can still find leverage in the roles and the structure. Our starting point is to create optimum roles. To do this we think about the tasks that only certain people in specific roles can do. Generally this is the higher paid, technical roles. We then drag all the other tasks, down through the organisation to the most appropriate cost point. We should end up with client-facing teams (often called pods) and support teams. To generate momentum, we then create grades for each role and define the characteristics required for each grade. These work as career ladders, providing individuals with a clear route up through the organisation. This mechanism drives growth as people push for promotion.

While we’re reorganising roles and teams, we need to make sure there aren’t any people lurking in the direct costs part of our P&L (income statement). We can’t be paying anyone a chunk of the revenue they bring into the business. That kind of compensation structure is a tax on scale. So when we change the roles, we will need to exchange any outdated compensation structures for a base salary and incentive scheme payment. The latter can be balanced between individual and team performance. Now is also probably the time to align the teams’ incentives with the owners, so an employee share option plan (ESOP) is a good move.

Once we structure the business for scale, were going to want to accelerate that growth, which we can do with the recruitment of individuals or teams that can bring business with them and of course there’s always acquisitions. In-organic growth will need to be funded and comes with both execution and integration risks. Careful planning is essential, as is timing.

This brings us neatly back to funding. In this stage, you are committed to growth and you must be realistic about how it’s funded. An equity investor will have expectations and you will lose a degree of control if you take one on. It’s unavoidable. You will also lose future profits, so if you really believe in your business and your strategy for scale, you’re going to want to borrow if you can. There is a third option. Funding scale yourself. This is only really advisable if you’ve achieved financial independence personally. When your own personal finances are secure, you can play the game like executives in big businesses do (ie take more asymmetrical risk).

You will know you’ve reached the summit of Scale-up Mountain when you’ve broken even on your investment and are consistently growing profits ahead of costs. Velocity and inertia have combined to create momentum. The experience feels a bit like setting yourself on fire and running as fast as you can to put the flames out. But to the victor go the spoils and from this lofty perch, you can sit tight and bask in the glory of your achievements (ie bank the free cashflow in the form of dividends), or sell the firm and cash out (expect eight to twelve times profit or more as a multiple), or move on to the last peak which has just come into view; Re-up Mountain. Energy, enjoyment levels and your timeline will be significant factors to consider when deciding whether to climb it.

Re-up

The last and highest mountain in the range is Re-up Mountain. You can’t even see it until you reach the peak of Scale-up Mountain. In many ways it’s a bit like Mount Everest. There are a lot of factors that make it dangerous but with the right team and resources, you can reach the summit. Your goal is dominance and you’re going to want to approach this one with a competitive spirit.

By now, you’re running a big business. Towards the E end of the SME scale. The Re-up stage is really the gateway to a fully fledged enterprise business. This means identifying market opportunities and competing in a way that allows you to dominate. You will probably extend and diversify your proposition to capture market share. You may also want to build out key geographical territories and depending on the business you’re in, this might mean domestic or global activities.

Given the journey you’re on, it’s unlikely that you are still driven solely by financial gain. You should be financially independent by now and unless you’re a very greedy fish (if you are you’re not reading this), the driver is more likely to be purpose. While ‘making the world a better place’ is somewhat cliché these days, if you find yourself in a position to make a meaningful, positive contribution to society, that can be a compelling reason to climb Re-up Mountain.

Your primary challenge will be the rigidity of your business in it’s scaled-up form. The focus and discipline you baked into your culture, those decision rights you assigned to managers, they can now work against you as you attempt to innovate. Oh and politics. Those career ladders we created to scale-up; they’re now being climbed by ambitious individuals looking for promotion and control. Balancing often conflicting incentives and keeping middle management to a minimum while retaining clear lines of communication, will be major areas of focus for you.

As for strategy, you will be looking at the relative attractiveness of markets and your competitive position. You will also be thinking about areas of synergy that you can leverage to create mutually reinforcing benefits. You might want to focus on market intensive strategies (further penetration, research and development, new propositions etc), integration strategies (taking control of suppliers, competitors, or channels to market), diversification (new solutions and/or new markets), or defensive strategies (joint ventures, divesting business units etc). Your decision criteria might include return on investment, risk of losing capital, the impact on ownership and control, growth potential, prestige, social responsibility, the list goes on.

You will know when you’ve reached the summit of Re-up Mountain, when you’re ringing the bell at the stock exchange. You will have other options of course, but all this growth requires funding and for that to continue you will need liquidity, which is frequently found in public markets. From here, you should identify what you will do next. Few founders remain in their businesses for very long post-float and you want to plan an exit that befits your enormous contribution. You also want to straighten out the asymmetry in your personal life and repay those closest to you, because you wouldn’t get anywhere near any of the summits without their love, patience and support.

Summary Points

There are a few points worth considering as you think about where you are and where you might want to get to.

- Before you start and at each point where you move from one stage to the next, you need to ask yourself what you really want. There should be a financial incentive (so achieving financial security, financial independence, or financial autonomy) and a personal achievement goal.

- Honestly appraise the stage your business is currently in and map out the challenges that need to be resolved to move you to an optimised position. Remember, performance lags projects.

- Your business is unlikely to be fully in any one stage. Outliers will be based on the owners (or a key team member’s) area of specialisation, passion etc…

- Be honest about your ability, energy, and willingness to tackle the next growth stage.

- Time should be a major consideration in your decision to move from one stage to the next. Some projects take significant time to execute and it can be several years before you see a return. It should go without saying, but if you want to be retired in three years, don’t take on a growth stage with projects that generate a return in year five.

- Leverage is interesting. The traditional order in business is people, capital, and tech. Service firms are different and SME service firms in particular. In Start-up you leverage personal effort, in Grow-up you’re still leveraging your personal power but you’ll start to get some benefit from others. In Level-up you start to leverage both people and tech. In Scale-up you continue to leverage people and tech but introduce capital and all three are leveraged in Re-up.

- On strategy, the focus shifts from inward facing to outward facing, as you move up through the stages. The inflection point is often in the Level-up stage, where competition and other externalities start to have an impact.

- The strategies that move you through the growth stages, progressively layer key competencies and specific knowledge to create a compounding effect that should make it easier for you to derive the greatest benefit from the other three variables, taking risk, hard work and luck.

- Identify the key metrics, ratios (combinations of ratios) and trends (ratios over time) to monitor as you execute your strategy. Set the boundaries for course correction up front too.

- Balancing business as usual (BAU) with projects is a tricky one. In the early stages there’s less definition and resource, so people are just coping. As these two factors change and fragility is replaced by strength, project work gets easier to schedule and execute.

- Don’t skip a stage unless you’re using capital and even then, make sure you are going to end up with a business that has the desired characteristics.

- The most efficient way to climb the range is to get up to Level-up Mountain however you can, then remain there while you reach financial independence personally. Then use debt to climb Scale-up and Re-up Mountains. This meta strategy seems to give you the best set of options for your exit and takes the pressure off you and your family, allowing you to take some calculated risks along the way.

The growth stages are a map. In developing them, my aim is to create a degree of predictability to the SME business journey and to help a greater number of business owners to realise their ambition. Starting and growing a business is difficult at the best of times and I wanted to create a map that might help guide the way. As ever, there’s a big difference between the map and the territory. Good luck and enjoy your climb.